3 Big Flaws in B2B Marketing Attribution...and How to Fix Them

- Renee Joneck

- Mar 14, 2023

- 5 min read

Updated: Jun 30, 2025

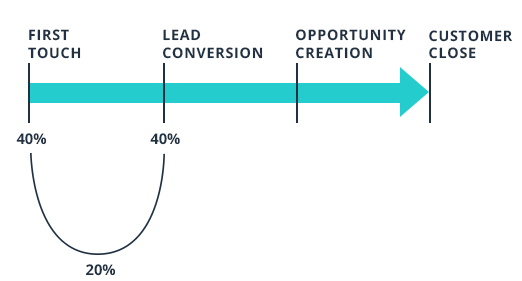

B2B marketing attribution is the process of identifying and assigning value to select marketing campaign touch-points that contribute to a customer's buyer journey. There are several marketing attribution types, but the most common include: Last Touch, First Touch, Linear or Equal Weight, and U-shaped or Horseshoe.

While it's essential for measuring the effectiveness of marketing campaigns, there are several flaws that can impact its accuracy.

Below are four key ones that I've seen consistently:

Flaw #1: Incomplete Data

B2B marketing attribution relies on accurate and complete data to track target customer interactions with marketing campaigns.

Leads don't have full contact data. We know lead forms have to request minimal information to encourage conversion. They can't possibly be an MQL if their Demographic info is missing.

In addition to contact data, knowing Where the Lead came from (Source) is imperative. I've consistently seen Lead sources and campaign nomenclature misused and mislabeled, preventing proper attribution. Example: you may list the Lead came from LinkedIn and some of your biggest deals came from LinkedIn. That's wonderful if you're only running asset type, one message type, one creative iteration.

The Fix

Marketing must ensure Leads are appended/enriched before they are defined as an MQL. One way to maintain this is with an enrichment tool like ZoomInfo or Clearbit. They both can enrich in real-time and regularly append the data as new contact info is acquired. Another way is to set up progressive profiling (PP) on their lead forms. As the prospect goes through their journey and encounters gated paths, they have the option to update their contact info. The farther the journey, the more invested they are in giving additional detail (1st touch = name email > 3rd touch, they may give title and business email).

If you have more than one campaign running (and you should), please ensure your source and campaign names are properly built and the fields are visible at the Lead AND Contact level. Many companies don't realize if this information isn't also visible at the Contact level, all of the top funnel data is lost the moment that Lead is converted to a Contact and attached to an Account.

Flaw #2: Over-Attribution

Yep, it's a thing. It's attributing revenue to particular marketing channels, especially if it's the Last Touchpoint before a conversion. This is why Marketing has to tightly align with Ops and Sales to define relevant touchpoints and what 'conversion' means to the business, not just marketing.

Let's dive into this a bit....example: if you're only 'valuing' the last touchpoint before conversion, it will lead to misguided decisions and ineffective resource allocation.

This happens often with Equal/Linear and Horseshoe/U-Shape models. It becomes a manual effort, even if you acquire a tool like Bizible - and can delay success if you don't have the personnel resources to handle the reviews quickly. You'll have to review the campaigns, assets used and sources, determine the common trends of acquisition channels and map it against revenue, average-deal-size, time-to-close, and buyer groups to determine the most profitable mix. The more touches you're evaluating manually, the longer it will take to assess...delaying campaign optimization and slowing down pipeline growth.

The Fix

This goes back to marketing staying aligned with sales and business goals. Align your attribution so you can properly implement and quickly assess what's working for the business.

Keep it simple to start. Use the First Touch model. First Touch is typically where you're spending your budget and the metric you'll use to determine CPL and need for budget modeling.

Flaw #3: Lack of Transparency

Working in a bubble is the biggest challenge I've seen with Marketing teams. By not sharing the attribution model with Ops and Sales, and aligning on the criteria, you encourage the misalignment and distrust in the numbers presented by Marketing.

Criteria to consider:

Sales creates their own First-Touch model with their AEs. This means AEs receive 100% commission on First-Touch acquisition from AE/Outbound sourced deals. The AE’s commission percentage may decrease on deals driven from Marketing/Inbound and the number of campaign touches the account engages in before the deal closes.

A TRUE story on the impact of not considering the criteria:

Marketing acquires a Lead at a tradeshow, Joe from XYZ company, but Joe doesn't MQL right away. Acquisition date is stamped as January 10th

An AE (Tom), is at the same tradeshow and acquires the decision-maker Jane from XYZ company at the show's reception and on January 12th, logs her into Salesforce as sourced from Prospecting.

Back home, Tom follows his sales process and works with Jane to qualify this opportunity with XYZ. During this time, Joe MQLs and marketing follows their process of placing him in a multi-touch marketing nurture until the AE engages. Tom is distracted with Jane, as she's the buyer, and never engages with Joe - instead he attaches his contact record to the XYZ account, and continues to work with Jane.

After a six month sales cycle, Tom not only qualifies the Opportunity but wins the deal for six figures. Tom is elated, he brought in the deal from his prospecting - it's a big win for the business and Tom's bank account. So he thought.

Here's where things fell apart. The Ops process paid commissions based on the First-Touch model: attribution credit based on date of the first conversion activity, which in this case was an MQL from Marketing/Inbound.

When marketing gave their attribution (and influence) report to the executive team, the report showed marketing's full influence on the closed/won deals for the quarter and XYZ company was included. Beyond the first touch engagement, the two XYZ contacts engaged in many marketing nurture campaign touches during the six month sales cycle - which is normal during consideration and validation stages of the cycle.

Marketing didn't know about the comp structure with sales and sales didn't understand the relevance of marketing's attribution model to their comp plan. Only Ops was aware - and they didn't have a seat at the table in these review meetings.

Unfortunately, because of this disconnect - the sales rep, Tom, only received 10%, Ten Percent, TEN PERCENT of that six figure deal. Ops had already paid out the commissions and to revisit and change the process would take months....which meant nothing changed.

Many other deals like this were uncovered as AEs started to double check their pipeline and payouts. The trust between sales and marketing fell apart.

The Fix

Everything...take the time to collaborate, document, understand cross-functional needs and objectives. Agree on a path forward and help Ops prioritize implementing the process.

Possible solutions:

1. The AE should have received 100% of his commission as he closed the deal, Marketing doesn't receive commission, even when they're responsible for driving 90% of new pipeline.

2. Marketing teams should receive some sort of commission on the review they've influenced, especially at first-touch.

3. B2B orgs have to value Sales and Marketing equally. They are partners, must work as partners and no matter what anyone says, they can't fully succeed without the other. The competition and lack of transparency - and empathy - has to go away. The fact misalignment between Sales and Marketing has *spiked to 58% in 2023 is heartbreaking....and preventable.

*source: Revenue Marketing Alliance

Comments